Residency Information

Use the links below to navigate to each section

Residency

Please read all sections before submitting your residency questionaire.

The Residency Reclassification Questionnaire and supporting documents should be submitted prior to the start of the term the student is requesting to be reclassified as a resident or 10 days after your application was submitted.

As per California Code of Regulations, 54026, California Administrative Code, the burden is on the student to demonstrate clearly both physical presence in California and intent to establish California residence by the residency determination date of the semester/term they are trying to establish California residency for educational purposes.

|

Term |

Proofs Must Be Between the Date Range |

Deadline to Submit Residency Reclassification |

| Winter 2024 | January 3, 2022 - January 3, 2023 | January 12, 2024 |

| Spring 2024 | February 17, 2022 - February 17, 2023 | April 30, 2024 |

| Summer 2024 | June 16, 2022 - June 16, 2023 | July 11, 2024 |

| Fall 2024 | August 25, 2022 - August 25, 2023 | November 3, 2024 |

| Fall 2023 | Fall 2023 Appeal process deadline has passed. If you have a pending Petition please follow up with Brenda Peterson | We will not process any new Fall 2023 requests. |

All proofs of residency must be dated at least one year and one day prior to the start of the term for which residency is sought. Proofs cannot be older than 2 years old; except California Driver License and or California ID can be older than 2 years.

Resident: Unless precluded, a “resident” is a student who has been physically present in the state for more than one year immediately preceding the residence determination date (one year and one day) for a term and has demonstrated an intent to make California a permanent home. EC § 68017

Nonresident: A “nonresident” is a student who does not have residency in the state for more than one year immediately preceding the residence determination date for a term. EC § 68018

To establish residency, a student needs to meet the three conditions below, subject to verification by A&R by submitting the:

Residency Questionnaire and upload your supporting documentation.

The burden of proof to demonstrate legal status, physical presence, intent to establish residency in California and financial independence is on the student (EC 68041).

- Legal Status that permits the establishment of domicile in the United States. Essentially, the student must be a US Citizen, Permanent Resident, eligible Temporary Resident, hold eligible Visa, etc. Legal status must be sustained for at least one year plus one day prior to the start of the term. This date is known as the Residency Determination Date (Title 5 § 54045).

- Physical presence is proved by being physically and continuously present in California for one year plus one day prior to the start of the term (the Residency Determination Date). (Title 5 § 54020 and § 54022).

- Intent is proven by providing evidence demonstrating intent to make California a permanent home of residence (see "Acceptable Proofs" section below). Taking any of these actions (not an exhaustive list) demonstrates a lack of intent to make California a permanent home of residence: filing taxes in another state as a resident of that state; filing for divorce or a lawsuit in another state; paying resident tuition in another state; voting in another state. Moving to California for educational purposes alone does not grant residency (Education Code, Section 68062(d)).

- Student Financial Independent Status: California Education Code requires that financial independence is to be considered when a nonresident student is seeking reclassification. If you are an adult student and your parents are not California residents, you must demonstrate financial independence, along with physical presence and intent. Please answer the following questions regardless of your age. (CA Ed Code 68044, title 5 54020, 54032)

- To establish or change a residence, a person capable of establishing residence must couple their physical presence with objective evidence that the physical presence is with intent to make California the home for other than a temporary purpose. EC §68062(d); Note: Physical presence alone is insufficient; intent alone is insufficient.

Conduct Inconsistent with Claim on California Residency

Some examples include:

- Possessing a driver’s license or state identification, and/or vehicle registration in another state.

- Being a petitioner in a divorce or lawsuit as a resident in another state.

- Attending an out-of-state educational institution as a resident of that state.

- Declaring nonresidence for California income tax purposes.

- Presence in the United States as a citizen of another country with a nonresident visa.

As per California Code of Regulations, 54026, California Administrative Code, the burden is on the student to demonstrate clearly both physical presence in California and intent to establish California residence.

Student Financial Independent Status: California Education Code requires that financial independence is to be considered when a nonresident student is seeking reclassification. If you are an adult student and your parents are not California residents, you must demonstrate financial independence, along with physical presence and intent. Please answer the following questions regardless of your age. (CA Ed Code 68044, title 5 54020, 54032)

Eligible Visas that may be approved for California residency if they meet the residency requirements. A-1,2,3; E-1,2,3; G-1,2,3,4,5; H-1,1B,1C, or 4, I; K-1,2,3,4; L-1A,1B,2; N-8,9; NATO-1 - NATO 7; O-1 or 3; R -1,2; T -1,2,3,4; U-1,2,3,4; and V - 1,2,3.

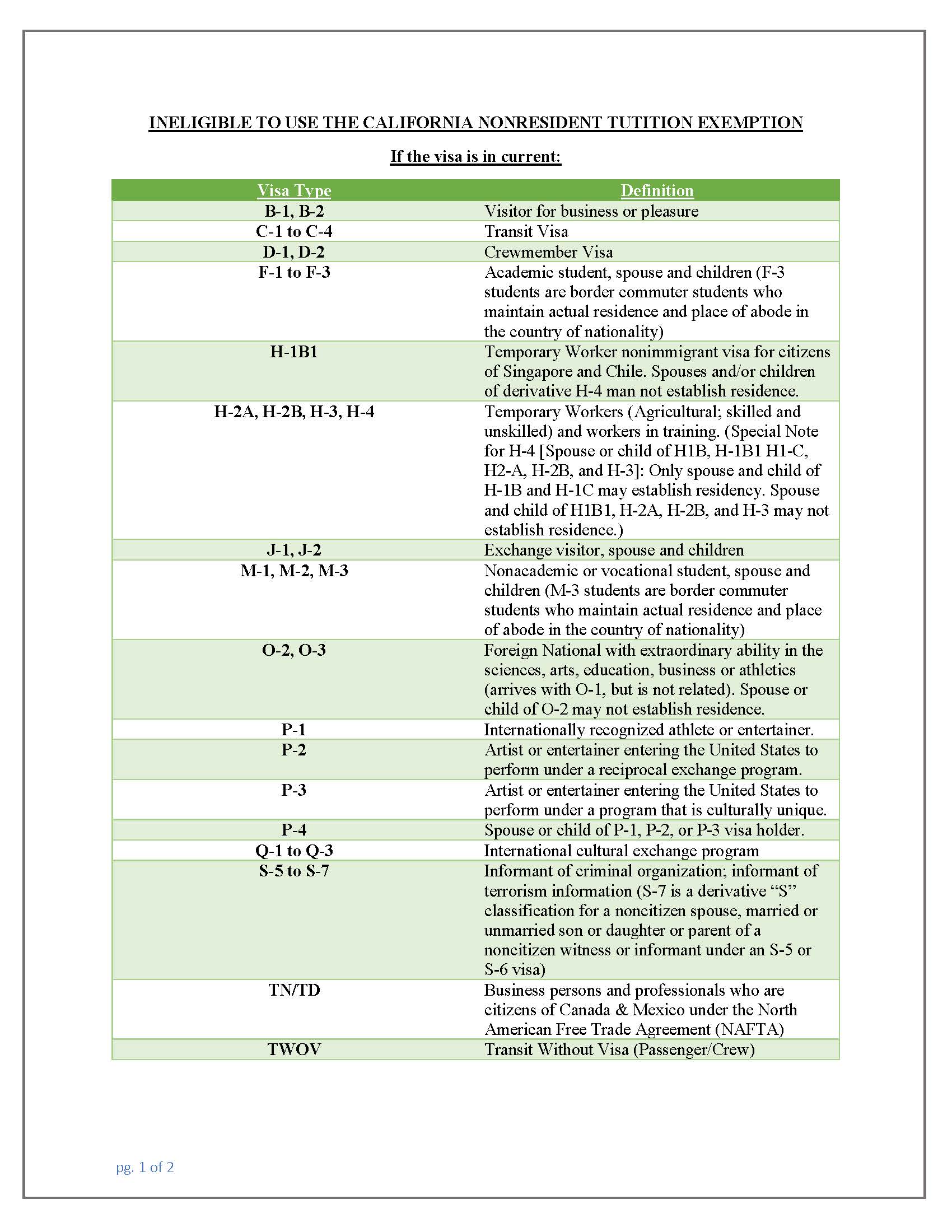

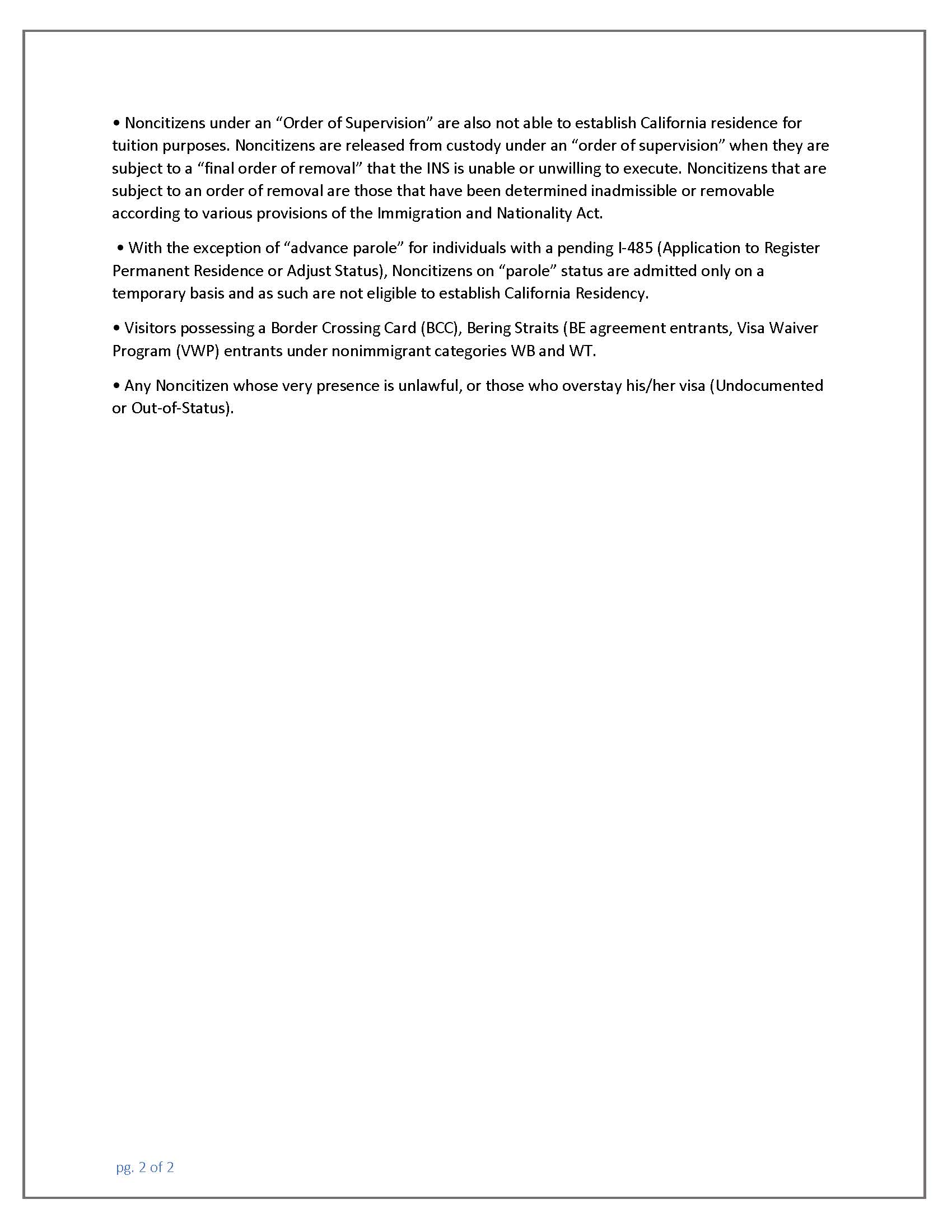

Visas Precluded from establishing residency regardless of their length of stay in the U.S.: B- 1,2**; C1,1D,2,3,4; D - 1,2; F -1,23; H -2A,2B,3, H-4 (If spouse or child of H-1B1,2A,2B,or 3); J -1,2; M -1,2,3; O-2,3 (If spouse or child of O-2); P -1,2,3,4; Q -1,2,3; S-5.,6; TWOV(Transit without visa), and NAFTA TN and TD. Undocumented and out-of-status immigrants are also prohibited from establishing residency. Also precluded are aliens under an Order of Supervision, on parole status, visitors possessing a Border Crossing Card (BCC), Bering Straits (BE) agreement entrants, Visa Waiver Program (VWP) entrants under nonimmigrant categories WB and WT, and aliens whose presence is unlawful. **B-1,2 are not eligible to study at El Camino College.

EC section 68075.6 grants an immediate nonresident tuition fee exemption to eligible Special Immigrant Visa (SIV) holders and refugee students who settled in California upon entering the United States. This exemption is granted for one year from the date the student settled in California upon entering the United States.

This exemption applies to the following:

- Iraqi citizens or nationals (and their spouses and children) who were employed by or on behalf of the United States Government in Iraq (Pub.L. No. 110-181, § 1244)

- Afghan and Iraqi translators (and their spouses and children) who worked directly with the United States Armed Forces (Pub.L. No. 109-163, § 1059)

- Afghanistan nationals who were employed by or on behalf of the U.S. government or in the International Security Assistance Force (ISAF) in Afghanistan (Pub.L. No. 111-8, § 602}

- Refugee students admitted to the United States under Section 1157 of Title 8 of the United States Code

As per California Code of Regulations, 54026, California Administrative Code, the burden is on the student to demonstrate clearly both physical presence in California and intent to establish California residence.

- Documents submitted for consideration must be dated at least one year and one day prior to the Residency Determination Date. Documentation older than 2 years may not be considered. Non-citizens must provide proof of their eligibility to establish residency.

- El Camino College reserves the right to request additional documents when those presented do not sufficiently demonstrate legal status, physical presence, intent, financial independence (as relevant) and the “one year plus one day” requirement. A minimum of two proofs must be submitted with the Residency Reclassification Questionnaire (at least one *Primary and one *Secondary from the list below. If you submit 2 primary proofs a secondary is not necessary. However, if you do not have a primary proof you must submit a minimum of three secondary proofs.

- *Primary and/or Secondary proofs must be from different sources. (for example all proofs cannot be from the DMV).

Documents listed in order of precedence. Not an exhaustive list. If you have other documentation that you feel will support your reclassification submit them with the Residency Reclassification Questionnaire.

| Documentation that may be used to satisfy residency factors: | Physical Presence | Intent | Financial Independence | Primary or Secondary Proof |

|---|---|---|---|---|

| Filed California Income Tax (Form 540, page 1-2 as submitted to the Franchise Tax Board) with California address. If filed for an extension, a copy of the IRS tax extension receipt is needed along with a copy of your W-2 for that year. Form 540NR not acceptable | X | X | X | Primary |

| California Driver's License or California ID card or DMV printout | X | X | Primary | |

| California Vehicle Registration–California Registration Certificate | X | X | Primary | |

| California Voter's Registration Card or print out form County Registrar’s Office (within or before date range | X | Primary | ||

| Official license from California Department of Consumer Affairs for Business or Individual practice | X | X | Secondary | |

| California Bank Account Statements showing a California Mailing Address | X | X | Secondary | |

| Marriage License or Divorce Decree issued in California with a California Mailing Address | X | X | Secondary | |

| Paycheck stub or letter of employment verification on company letterhead with dates of employment noted (wet signature needed; signed by the Human Resources manager) | X | X | Secondary | |

| Receipt of Benefits from a California State Agency | X | X | X | Secondary |

| Documentation of purchase and occupancy of residential real estate in California – loan papers, tax receipts, escrow paper | X | X | X | Secondary |

| Selective Service Registration showing California Permanent Address | X | X | Secondary | |

| California Utility Bills (e.g., electricity, phone, or water) covering a one-year period | X | X | Secondary | |

| California Health Insurance or Medi-Cal ID with Effective Date | X | Secondary | ||

| California Health Insurance or Medi-Cal ID with Effective Date | X | X | X | Secondary |

| W-2 Form with a California home address--only if taxes not filed | X | X | Secondary | |

| California property taxes | X | X | X | Secondary |

| Union membership in a California local | X | Secondary |

California Nonresident Tuition Exemption (Commonly Known as AB 540)

Please read all information before you submit the AB 540 Tuition Exemption Affidavit

Any student, other than one with a United States Citizenship and Immigration Services (USCIS) nonimmigrant visa status (see Requirements for students who have been granted T or U visa status), who meets all of the requirements, shall be exempt from paying nonresident tuition at the California Community Colleges, the University of California, and the California State University (all public colleges and universities in California).

- The student must have:

- attended a California high school (public or private) for three or more years or

- attained credits earned in California from a California high school equivalent to three or more years of full-time high school course work and attended a combination of elementary, middle and/or high schools in California for a total of three or more years and

- The student must have graduated from a California high school or attained the equivalent prior to the start of the term (for example, passing the GED or California High School Proficiency exam) and

- The student must file an affidavit with the college or university stating that he or she has filed an application to legalize his or her immigration status or will file an application as soon as he or she is eligible to do so.

- This exemption to the requirement to pay the nonresident tuition fee is often referred

to “AB 540” after the Assembly Bill

which enacted the exemption. (Ed. Code, § 68130.5.)

In 2014, Assembly Bill 2000 was enacted amending Education Code section 68130.5 to allow this additional flexibility in

meeting the requirements for the exemption.

Students who are nonimmigrants who are victims of trafficking, domestic violence,

and other

serious crimes who have been granted T or U visa status, under Title 8 of the United

States

Code, sections 1101(a)(15)(T) or (U) are eligible for this exemption.

- In 2012, Assembly Bill 1899 was enacted into law exempting holders of T and U visas from paying nonresident tuition. (Education Code, § 68122)

- The student must file an exemption request including a signed affidavit with the college

that

indicates the student has met all applicable conditions described above. Student information

obtained in this process is strictly confidential unless disclosure is required under law. - Students eligible for this exemption who are transferring to another California public

college or

university must submit a new request (and documentation if required) to each college under

consideration - Nonresident students meeting the criteria will be exempted from the payment of nonresident

tuition, but they will not be classified as California residents. They continue to be

“nonresidents”.

- The California Dream Act extends Cal Grant A and B Entitlement awards, Cal Grant C

awards,

Chaffee grants, and institutional financial aid to students that meet these criteria as well as the

applicable criteria for eligibility for specific types of financial aid.- Make sure you fill out the California Dream Act Application: https://dream.csac.ca.gov/landing

- California Nonresident Tuition Exemption does not provide federal student financial

aid eligibility for undocumented students.

These students remain ineligible for federal financial aid.